Earnings Per Share Interpretation

What is the Price Earnings Ratio. The Price Earnings Ratio PE Ratio is the relationship between a companys stock price and earnings per share EPSIt is a popular ratio.

Earnings Per Share Definition Formula Example Interpretation Analysis

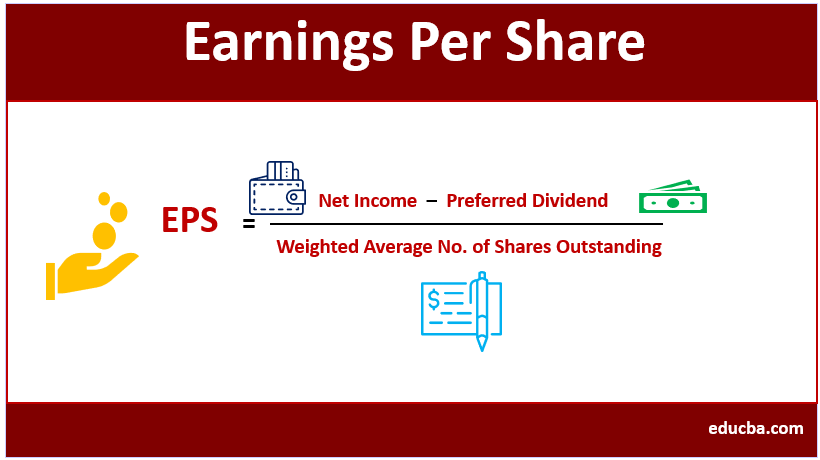

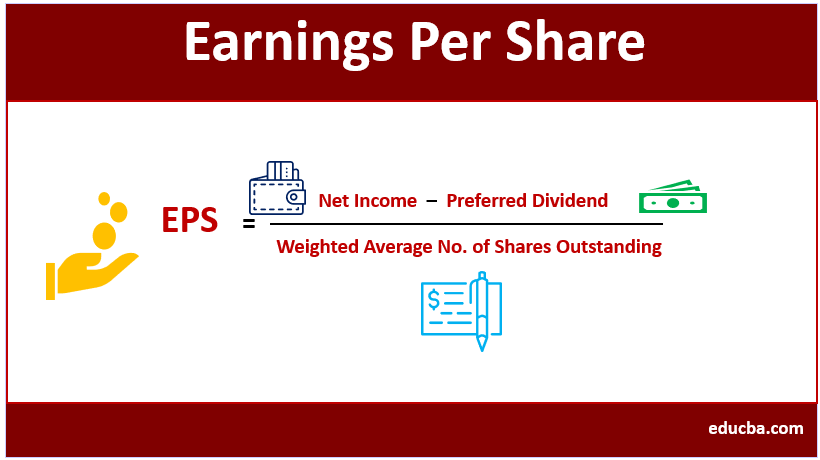

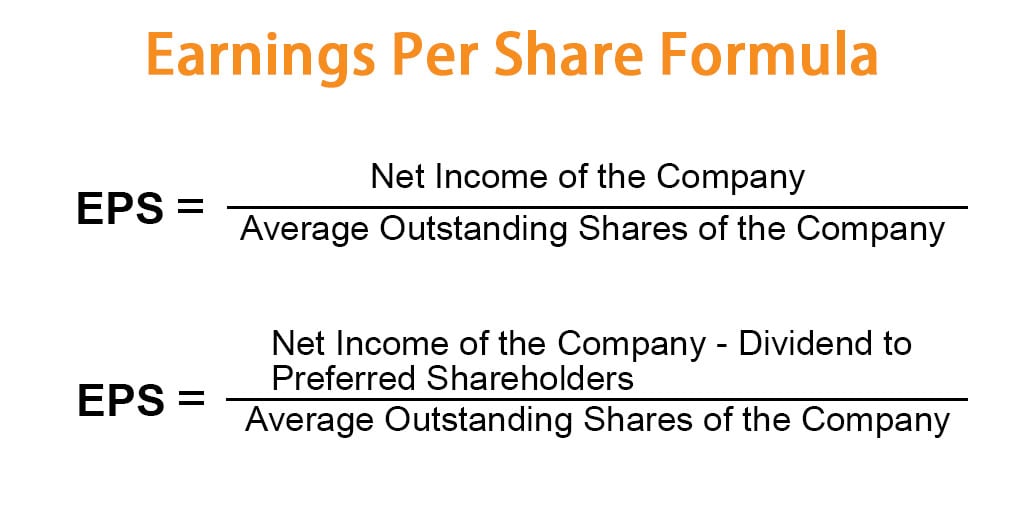

You can calculate a companys EPS using this formula.

. Earnings per share represents that portion of company income that is available to the holders of its common stock. EPS Net Income Preferred DividendsEnd-of-Period Common Shares Outstanding. Ad These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience.

The interactions among potential ordinary share issues might cause diluted earnings per share EPS to be moderated under certain circumstances it is important. Price to Earnings Ratio Current Stock Price in the MarketPrior 12 Months of Earnings per Share. The following is the formula.

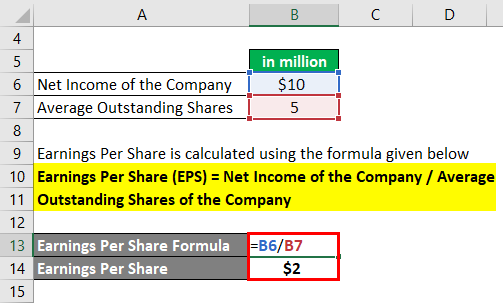

Wide Range Of Investment Choices Including Options Futures and Forex. Ad Discussion And Analysis Of Significant Issues Related To Financial Statement Presentation. If a company with 1000 shares earns 10000 its EPS is simply 10 10000.

The high See more. It is most commonly used by investors buyers. Our Updated Handbook Explains The Principles Of ASC 260 Through QAs And Examples.

PE Ratio of a Stock Current Market Price of the stockEarnings per share. Example 2 EPS computation with cumulative preferred stock. Ad Discussion And Analysis Of Significant Issues Related To Financial Statement Presentation.

The current market price of the stock can be obtained from the. The measure is closely monitored by investors who use it to. Earnings per share EPS is the most important metric to use when youre analyzing a stock.

The resulting number serves as an indicator of a companys profitability. The interactions among potential ordinary share issues might cause diluted earnings per share EPS to be moderated under certain circumstances it is important that. It is used to measure the success of management in achieving profit for.

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. Earnings Per Share EPS Earnings Shares. Earnings power value is a method used to find out the intrinsic value of a companys stock assuming constant profits and no future growth.

10 lakh and must also pay Rs. Earnings power value per. Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages.

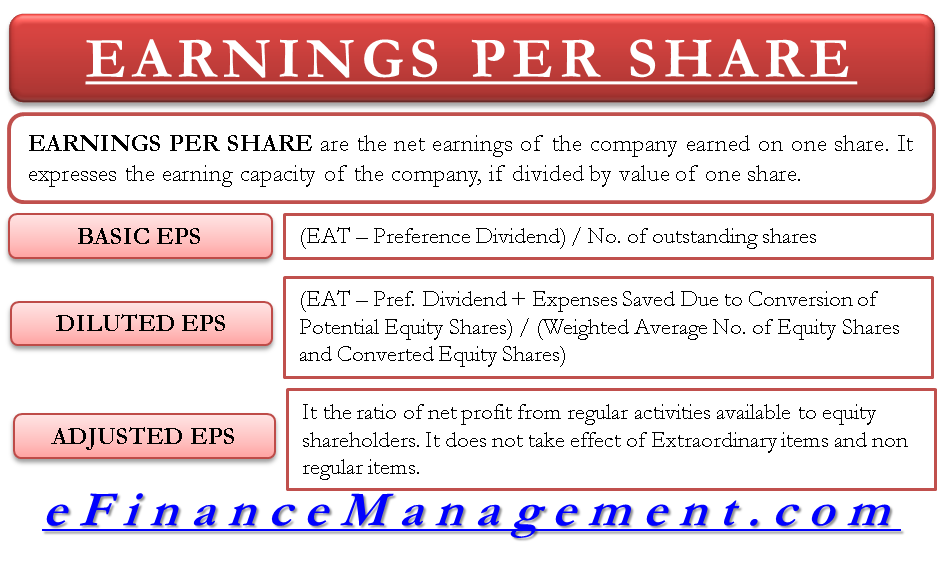

It is common for a company to report EPS that is adjusted for extraordinary itemsand potential share dilution. Price-Earnings Ratio - PE Ratio. Earnings per share EPS is calculated as a companys profit divided by the outstanding shares of its common stock.

Earnings per share Net incomeWeighted average number of shares outstanding 300 per share. PE Ratio Formula. In other words it is a market prospect ratio that.

Earnings per share EPS is the part of a companys profit that a company allocates to each outstanding share of common stock. Our Updated Handbook Explains The Principles Of ASC 260 Through QAs And Examples. For instance a company XYZ is left with a net income of Rs.

As you can see calculating basic Earnings Per Share is easy. The earnings per share ratio tell a lot about the current and future profitability of a company and can be easily calculated from the basic financial information of an organization that is easily. So the earnings per share ratio EPS is the total earnings divided by the number of outstanding shares.

Basic Earnings Per Share Eps Formula And Excel Calculator

Earnings Per Share Advantages And Limitations Of Earnings Per Share

Earnings Per Share Formula Eps Calculator With Examples

Earnings Per Share Formula Eps Calculator With Examples

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Comments

Post a Comment